OPC (One Person Company)

What is OPC registration?

One Person Company (OPC) is a new concept introduced in the Companies Act, 2013 in India, which allows a single person to incorporate a company with limited liability. OPC combines the benefits of both sole proprietorship & a company, giving the sole owner complete control over the company’s operations, as well as limited liability protection, which was not available under sole proprietorship.

Before the introduction of OPC, a single person wasn’t able to incorporate a company as per the provisions of the Companies Act-1956. They had to form either a partnership or a sole proprietorship to carry out their business activities. These forms of businesses having unlimited liability, which meant that the owner’s personal assets were also at risk in case of business failure or for any de

OPC is a suitable option for small businesses or startups where the owner wants to limit their liability while having complete control over the business operations. It also eliminates the need for appointing a second director, which is mandatory in a private limited company, thus reducing compliance requirements and costs.

According to Section 2(62) of the Companies Act 2013, a company can be only formed having one director & one member, which means that a single person can form a One Person Company (OPC) in India.

OPC registration in India is a popular choice for small business owners as it has fewer compliance requirements compared to a Private Limited Company. OPCs generally not required to hold an annual general meeting or maintain statutory registers. Additionally, OPCs are exempted from certain provisions of the Companies Act, such as the requirement to appoint an independent director, making it easier for entrepreneurs to start & run their businesses.

The first step to register a company in India is to obtain name approval from the Ministry of Corporate Affairs (MCA). This process usually takes 24-48 hours. It is important to note that the name of a Private Limited Company in India must end with the words “Private Limited”, while a One Person Company must end with “(OPC) Private Limited”. Limited Liability Partnerships (LLPs) must end with “LLP”, and Section 8 companies can end with words such as “Foundation”, “Association”, or “Institution

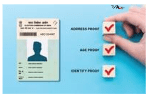

Documents Required for OPC

Aadhaar Card

Passport

Pan Card

Voter ID Card

Electricity Bill

Driving License

Telephone Bill

Bank Statement

Sale Deal Copy

AOA Subscriber Sheet

MOA Subscriber Sheet

Lease/ Rent Agreement

Passport Size Photograph

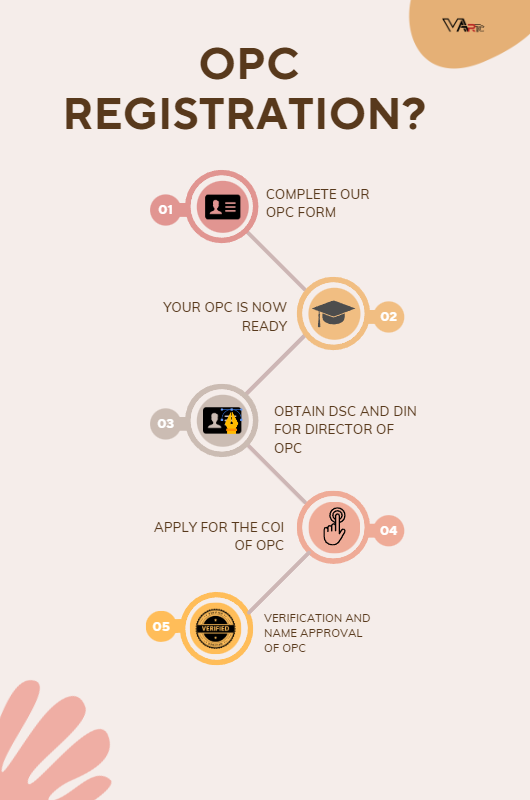

Steps to Incorporate a One Person Company (OPC) in India:

Step 1:

Check the eligibility criteria & gather the necessary documentation, including the Memorandum of Association (MOA) & Articles of Association (AOA).

Step 2:

Obtain Digital Signature Certificates (DSCs) & Director Identification Numbers (DINs) for the sole director of the OPC.

Step 3:

Submit a name reservation request using the Spice+ form, provided by the Ministry of Corporate Affairs (MCA).

Step 4:

Apply for Permanent Account Number (PAN) & Tax Deduction & Collection Account Number (TAN) for the new OPC.

Step 5:

Once the name is approved & all documents are verified, the Registrar of Companies (ROC) issues an incorporation certificate with a PAN and TAN.

Step 6:

Open a bank account in the name of the OPC & start conducting business. The entire process of registering an OPC can be completed in around 20 days. It is recommended to seek professional assistance by filling the enquiry form to ensure a smooth and hassle-free registration process.

Frequently Asked Questions:

A: An One Person Company (OPC) in India is a type of company that was introduced under the Companies Act 2013. It is owned and managed by a single person, and combines the benefits of a sole proprietorship with those of a company.

A:One of the primary benefits of an OPC is that it combines the advantages of a sole proprietorship .OPCs are also easy to set up and manage, and require minimal maintenance. The registration process is simple, we help you to process it easily & completed online. Moreover, an OPC has better operational control and taxation benefits compared to other types of companies. OPCs are the ideal way to start a small businesses, with the ease of registration & low cost of operation,

A: A Digital Signature Certificate (DSC) establishes the identity of the sender or the signee electronically while filing the document online.Directors Signing of some of the application documents using their Digital Signature is mandate by MCA.

A: An Unique Identification Number that is assigned to all existing and proposed Directors of a Company called as Director Identification Number. All proposed Directors must require a Director Identification Number. The DIN never expires, and each person can have only one DIN.

A: OPC is a Company having separate existence & is owned by one single member. It is a mixture of proprietorship and company forms of business.

A: Yes, for an OPC, statutory audit is mandatory. A company needs to appoint a Chartered Accountant (CA) as the auditor of the Company. The auditor needs to verify the books of accounts then on the basis he issues a Statutory Audit report.

A: GST registration for an OPC is necessary if the supply of goods or services is in another state, irrespective of the annual turnover.

A: Yes, an OPC can raise funds through venture capital, financial institutions, or by converting into a Private Limited Company.

It is possible for a company to be struck off if the annual compliances are not met. Reviving takes up to 20 years.

A: The total number of shares that a company may issue to its shareholders is known as its authorized capital. A company must pay an issued capital fee to the the authorities before issuing shares