Certificate of Incorporation

A Private limited company is a type of Company that does not offer its shares to the General Public and is identified by the suffix "Pvt Ltd" in its name. In Order for such a Company to be established ,it is required to obtain a legal document or license that Permits its Operation.

Under the Companies Act 2013 ,Section 7 outlines the process for establishing a company and designates the Certificate of Incorporation as the Final requirement for Company incorporation. The Certificate of Incorporation is issued Either by the Ministry of Corporate Affairs or the State Government. This Document Grants the Company its legal identity and serves as a license to initiate Business Operations.

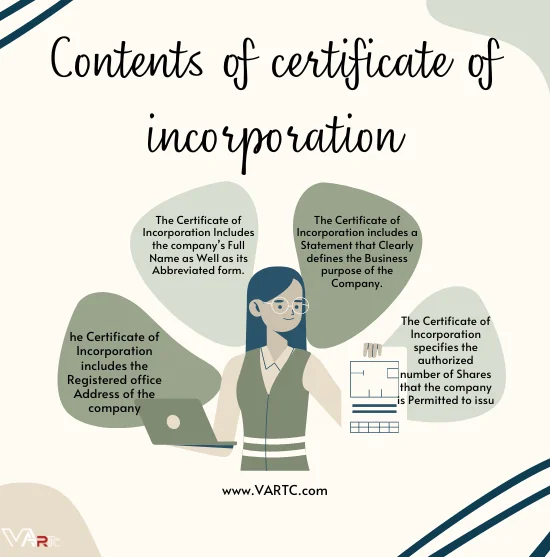

Contents of Certificate of Incorporation

The Certificate of Incorporation for a Private limited Company Comprises the following elements:

- The Certificate of Incorporation Includes the company’s Full Name as Well as its Abbreviated form.

- The Certificate of Incorporation includes a Statement that Clearly defines the Business purpose of the Company.

- The Certificate of Incorporation includes the Registered office Address of the company ,along with the Name of the registered Agent responsible for the Address.

- The Certificate of Incorporation specifies the authorized number of Shares that the company is Permitted to issue. Additionally ,if there are Multiple types of Stock ,the document also provides a description of each type.

Where Should You File for Incorporation?

While most businesses choose to incorporate in their home states ,it is important to consider alternative options. To determine the ideal location for incorporation ,you can pose the following questions to your team:

- Where do you plan to conduct most of your business?

- Where does your company have most of its offices, facilities, or employees?

If your business operates on a nationwide scale or has dispersed facilities and employees across the country ,it may be worth considering incorporation in a business-friendly state such as Delaware or Nevada. By doing so ,you can then file for foreign qualification in the other states where you intend to conduct business. This approach allows you to benefit from the favorable business environment of Certain states while expanding your operations in other Jurisdictions.

What Information Goes Into a Certificate of Incorporation?

The certificate of incorporation form varies for each state. It is essential to carefully review your state’s specific form before initiating the filing process. However, the following items are commonly required in most articles of incorporation:

- Corporation’s legal name, including an ending like “Inc.,” “Corporation,” or “Co.”

- Company’s official address

- Business code

- Type of corporation

- Business purpose

- Registered agent’s name and address

- Number of authorized stock shares

- Value of stock shares

- Board of directors’ names and addresses

- Incorporator’s name and address

- Filing date

It is worth noting that certain states may have more extensive requirements for the certificate of incorporation. For instance ,they may request additional details such as a document outlining stock rights ,preferences ,or provisions allowing for multiple types of stock. If your corporation is structured as a benefit organization ,you might also be required to specify the public benefit it provides. Therefore ,it is advisable to thoroughly familiarize yourself with your state’s specific guidelines and requirements for the certificate of incorporation.

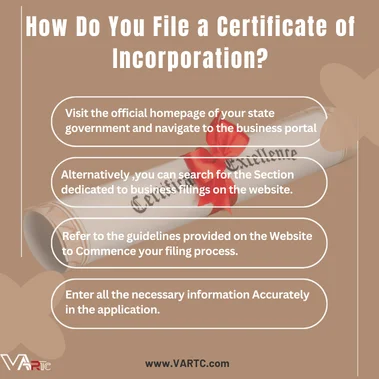

How Do You File a Certificate of Incorporation?

Almost every state facilitates online business filings ,Providing a convenient option for Submitting your articles of incorporation. To complete the process ,follow these steps:

- Visit the official homepage of your state government and navigate to the business portal. Alternatively ,you can search for the Section dedicated to business filings on the website.

- Refer to the guidelines provided on the Website to Commence your filing process. It is Possible that you will be required to Create an Account before proceeding with the submission of your business filing.

- Enter all the necessary information Accurately in the application. Prior to submitting ,take a moment to review the Application for any errors or inaccuracies. It is important to note that making Amendments to your filing can result in Delays and may require payment of an additional fee.

- Make sure to retain a copy of the submission confirmation, as it typically includes information about the processing timeline. You should receive an acceptance notice and a confirmation of your Certificate of incorporation automatically. However ,Mif several weeks elapse without any progress, it is advisable to proactively follow up with your state government to request an update on the status of your application.

How Much Does it Cost to File?

The fees Associated with Filing for a Certificate of Incorporation can differ depending on the requirements of each state. It is Possible for the filing Fee to be a fixed amount Applicable to all Corporations ,or it may be based on the number of authorized shares or a combination of factors. To Determine the Specific fee applicable in your state ,I Recommend visiting the website of your State’s Secretary of State Office ,where you can find the relevant Information.

It is important to consider that the filing fee is only one aspect of the costs that entrepreneurs need to budget for when establishing a corporation. Additional expenses may arise from various legal and government filing fees.

- State franchise tax is imposed as a Fee for the Privilege of Conducting business as a Corporation within the state.

- Business licenses and Permits are required based on the Specific type of Business and its Geographical location.

- Attorney’s fees encompass the costs associated with seeking legal guidance ,as well as the Professional assistance provided for handling legal documents.

Obtaining a Certificate of Incorporation

To obtain a Certificate of Incorporation, the private limited company has to follow the below-mentioned steps:

- Obtain a Digital Signature Certificate (DSC) and Directors Identification Number (DIN): To Initiate the Process of Company incorporation ,the first Step is to acquire a Digital Signature Certificate (DSC) and a Directors Identification Number (DIN). The DSC is essential for all Electronic filings and is also required for filing the Memorandum of Association (MOA) and Articles of Association (AOA). On the other hand ,the Director Identification Number (DIN) is a distinct Number Assigned by the Ministry to Individuals acting as directors ,Serving as their Unique identity.

- Application for name approval: Following that, the subsequent procedure entails applying for the company’s name. The application for name approval must be forwarded to the Registrar of Companies. The approval process typically takes approximately 14 days from the date of application submission.

- Preparation of Memorandum of Association (MOA) and Articles of Association (AOA): The Memorandum of Association (MOA) and the Articles of Association (AOA) hold Significant Importance for the company. The MOA serves as a foundational document that outlines the company’s scope and Operations. On the other hand ,the AOA sets forth the rules ,regulations ,and Procedures for Conducting the Company’s Operations.

- Filing the e-forms and payment of fees with the Registrar: After thorough verification ,all the necessary e-forms must be Submitted to the Registrar ,along with the Payment of the required fees.

- Issuance of Certificate of Incorporation: Upon verifying all the submitted documents ,the Registrar will Send the Certificate of Incorporation to the Directors of the Company Via mail.

Modification of Certificate of Incorporation

Once the Certificate of Incorporation is Obtained ,it serves as the official identity of the company. In the event that the company intends to change its name ,certain steps must be followed. This includes checking the availability of a new name ,conducting an Extraordinary General Meeting (EGM) ,passing a special resolution ,and applying to the Registrar for name Approval as per Rule 29 of the Companies (Incorporation) Rules ,2014. After Receiving approval from the Registrar ,a fresh Certificate of Incorporation will be issued

In the event of a Company address change ,it’s important to note that the Certificate of Incorporation will not be altered. Instead ,the company must complete the Necessary application forms and update the Company’s master data to reflect the modified address. It’s essential to remember that the address listed on the Certificate of Incorporation reflects the Company’s address as of the date of Incorporation ,and retrospective changes are not possible.

A Certificate of Incorporation gives life to the company ,capturing all the essential details as of the date of incorporation. It Serves as a parallel to an individual’s birth certificate ,Symbolizing the beginning of the company’s existence.

Do You Need an Attorney To File for Incorporation?

You can choose to file the articles of incorporation for your business independently or seek the assistance of an attorney. Opting to hire a lawyer can provide several advantages: Ensure timely submissions: Attorneys are familiar with the standard timelines associated with business filings, helping you meet the required deadlines. Avoid mistakes: Lawyers have experience filing business documents and know what information to provide and how to answer questions accurately.

The certificate of incorporation form varies for each state. It is essential to carefully review your state's specific form before initiating the filing process. However, the following items are commonly required in most articles of incorporation: