Tax Deduction and Collection Account Number Registration

TAN Card

Tax Deduction and Collection Account Number ,commonly known as TAN ,is a 10-digit alphanumeric identification number. This unique number is necessary for individuals and entities who have the responsibility of deducting or collecting taxes. The Income Tax Department assigns this alphanumeric number in accordance with Section 203A of the Income Tax Act of 1961. Moreover ,it is mandatory to mention the TAN on all TDS (Tax Deducted at Source) returns.

Why is TAN Required?

Everyone must have a TAN since TIN facilitation centres will not accept returns that do not have Tax Deducted at Source (TDS) or Tax Collected at Source (TCS) deductions. If TAN is not stated, banks will not accept the challans for TDS/TCS payments.

Types of TAN Applications

There are basically two types of TAN applications. They are:

- Application for issuance of new TAN

- Form for change or correction in TAN data for TAN allotted

Reasons to Register a TAN

Proprietorship Require TAN

People who receive a salary are exempt from the source deduction requirement. However, sole proprietors are obligated to get TANs and withhold tax from paychecks as needed.

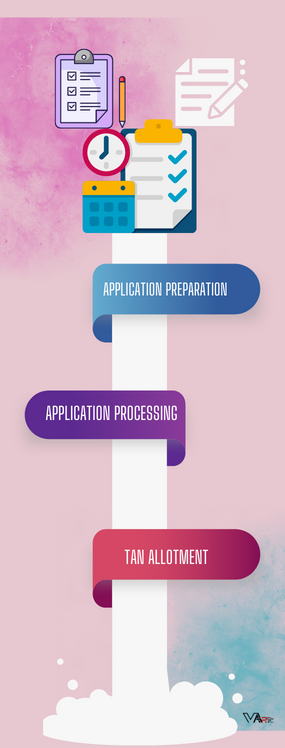

Application Preparation

At VARTC Tax Expert will prepare your TAN Application and obtain your signature in the format along with the necessary supporting documents.

Application Processing

VARTC will send the TAN Application to the Tax Department after it has been completed.

TAN Allotment

Once the application and the attached supporting documents are verified, the Tax Department will allot a TAN Number for your business.

An application for allocation in Form 49B must be submitted along with the necessary supporting documentation in order to receive a TAN. The TAN will be given to the entity based on the application. In all TDS/TCS returns, TDS/TCS payment challans, and TDS/TCS Certificates, the entity must include the TAN. The VARTC staff can assist you with obtaining your TAN registration fast and without any fuss.

Frequently Asked Questions:

Not any document is required to be submitted while making a TIN application.

Yes, you need to pay a minimal amount for availing a TAN card

Demand Draft and cheques should be in Demand Draft and cheques should be in favor of Protean eGov Technologies Limited-TIN. apply for a new TAN ?

In case of relocation within the same city then it is not required. However, if the relocation is happening in different cities then you are required to surrender the existing TAN and apply for a fresh TAN.

A printout from the website of the Income Tax Department of the webpage showing the details of TAN will be helpful in showing that you can TAN.

No, you can never use PAN in place of TAN under any circumstances as they both serve different purposes.

The original TAN should be used in case a duplicate TAN is being obtained.

An improvement notice is if a Food Business Operator fails to comply with the food regulations set in the FSS Act, 2006. An improvement notice can be issued by a Designated Officer (DO) of the food safety department.