LLP Registration Company in India

What is Limited Liability Partnership?

Limited Liability Partnership (LLP) has gained popularity as a preferred form of organization among entrepreneurs in India. Combining the advantages of a partnership firm and a company, an LLP is established by a minimum of two partners who enter into an LLP agreement. Notably, the partners in an LLP enjoy limited liability, similar to a company, and the LLP also benefits from perpetual succession. This unique structure offers entrepreneurs a flexible and liability-protected business setup.

In 2008 ,India introduced the concept of Limited Liability Partnership (LLP) regulated by the Limited Liability Partnership Act, 2008. To incorporate an LLP ,a minimum of two partners is required, and there is no Restriction on the maximum number of partners allowed in an LLP. This legal structure offers businesses the advantage of limited liability and flexibility in partnership ,making it a popular Choice for Entrepreneurs and professionals alike.

Within the partnership ,there must be a minimum of two designated partners who must be natural persons ,with at least one of them being a resident of India. The LLP agreement governs the rights and responsibilities of these designated partners. They hold direct responsibility for ensuring compliance with all the provisions of the LLP Act ,2008 ,and the provisions outlined in the LLP agreement. These designated partners play a crucial role in managing the affairs of the LLP and upholding its legal obligations.

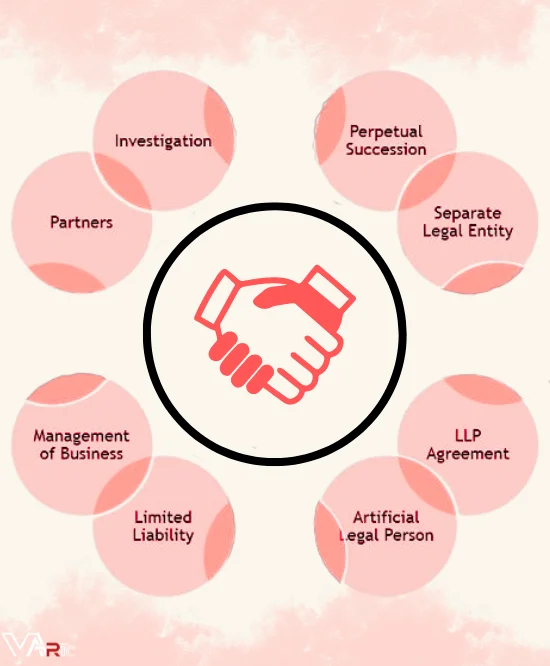

Features of LLP

- It has a separate legal entity just like companies.

- Minimum two persons should come together as partners to establish LLP.

- There is no upper limit on the maximum number of partners.

- There must be a minimum of two designated partners.

- At Least one designated partner must be a resident of India.

- The liability of each partner is limited to the contribution made by the partner.

- The cost of forming an LLP is low.

- Less compliance and regulations.

- No requirement of minimum capital contribution.

Advantages of LLP

Separate Legal Entity

Similar to companies ,an LLP enjoys the status of a separate legal entity ,distinct from its partners. It possesses the ability to sue and be sued in its own name. Conducting contracts under the name of the LLP fosters trust among stakeholders and instills confidence in customers and suppliers. This unique feature enhances the credibility of the business and portrays the LLP as a reliable and professional entity in the eyes of all involved parties.

Limited Liability of the Partners

The partners of an LLP enjoy limited liability, which means their liability is restricted to the extent of their contributions to the LLP. They are not personally accountable for any losses incurred in the business. In the event of the LLP’s insolvency during winding up, only the assets of the LLP are used to settle its debts. The partners are not held personally liable, allowing them to conduct business with credibility and without fear of personal financial risks.

Low cost and less compliance

Forming an LLP is cost-effective in comparison to incorporating a public or private limited company. Additionally, the compliance requirements for an LLP are relatively minimal. The LLP is obligated to file only two statements annually, which are the Annual Return and the Statement of Accounts and Solvency. This streamlined compliance process reduces administrative burdens and makes LLP an attractive option for businesses looking

No requirement of minimum capital contribution

An LLP can be established without any minimum capital requirement. There is no need for a minimum paid-up capital before proceeding with the incorporation process. The LLP can be formed with any amount of capital contributed by the partners, providing flexibility and ease in initiating the business setup. This feature makes LLP an attractive choice for entrepreneurs, as they are not burdened with capital constraints and can commence operations with the capital amount as agreed upon among the partners.

Disadvantages of LLP

Penalty on Non-compliance

LLPs enjoy minimal compliance requirements ;however ,failing to meet these obligations on time can lead to substantial penalties. Even if an LLP has no activity in a particular year ,it is still required to file annual returns with the Ministry of Corporate Affairs (MCA). Neglecting to file these returns can result in significant penalties for the LLP.

Winding up and dissolution of LLP

To establish an LLP , A minimum of two partners is necessary. If the number of partners falls below the required minimum (i.e., less than two) for a continuous period of six months, the LLP will be dissolved.

Additionally ,an LLP may also be dissolved if it becomes unable to pay off its debts.

Difficulty to Raise Capital

Unlike a company, an LLP does not have the concept of equity or shareholders. This means that angel investors and venture capitalists cannot invest in an LLP as shareholders since they would be required to become partners and take up all the responsibilities associated with it. As a result, angel investors and venture capitalists tend to prefer investing in companies, where they can be shareholders without assuming partner responsibilities. This distinction often makes it challenging for LLPs to raise capital from such investors.

- A single person cannot form LLP, a minimum of two members needed

- Two foreigners cannot form LLP without having one Indian partner

- LLP structure takes more days to form

- Partners undertake to contribute some amount towards the LLP firm

- Difficulty in the transfer of ownership

- FDI in LLP is allowed only through the Government route. FDI in LLP under automatic way is not permissible.

- LLP cannot raise External Commercial Borrowing (“ECB”)

Documents Required for LLP Registration

A. Documents of Partners

- PAN Card/ ID Proof of Partners – During the registration process of an LLP ,all partners are obligated to provide their PAN (Permanent Account Number) as it serves as a primary identification Proof. The PAN card is a crucial document that helps in verifying the identity of the partners and is a mandatory requirement during the LLP registration procedure.

- Address Proof of Partners –While registering an LLP, each partner must provide either a Voter’s ID, Passport, Driver’s license, or Aadhar Card as a valid address proof. It is essential that the name and other details mentioned in the address proof match exactly with those in the PAN card. In case there are discrepancies in the spelling of one’s name ,father’s name ,or date of birth between the address proof and PAN card ,it is necessary to correct these details before submitting the documents to the Registrar of Companies (RoC). Ensuring accurate and consistent information is vital to facilitate a smooth LLP registration process.

- Residence Proof of Partners – To Serve as a Valid residence Proof ,please Submit one of the following documents: the most recent bank Statement ,telephone bill ,mobile bill ,electricity bill ,or Gas bill. Ensure that the document is not older than 2-3 months and includes the name of the partner exactly as Stated on their PAN card.

- Photograph – Partners are requested to include their passport size photograph, preferably with a white background, along with the aforementioned documents to complete the submission of required proofs.

- Passport (in case of Foreign Nationals/ NRIs) – To become a partner in an Indian Limited Liability Partnership (LLP), foreign nationals and Non-Resident Indians (NRIs) must mandatorily submit their passports. The passports should either be notarized or apostilled by the relevant authorities in their respective countries. Alternatively ,the Indian Embassy located in their country can also authenticate the documents.

B. Documents of LLP

- Proof of the registered Office address must be Submitted during the registration of the company or within 30 days of its incorporation. This essential document is required to confirm the location and legality of the registered office ,ensuring compliance with the necessary regulations.

- If the registered office of the LLP is rented, the LLP must submit a rent agreement and a no-objection certificate (NOC) from the landlord. The NOC serves as the landlord’s consent, allowing the LLP to use the premises as its official ‘registered office’. These documents are essential to verify the legality of the registered office and ensure compliance with the required formalities.

- In addition ,the LLP must submit any one document out of utility bills such as gas ,electricity ,or telephone bills. The chosen bill should display the complete address of the premises and the owner’s name. It is Important to note that the utility bill must not be older than two months from the date of submission. These Documents play a crucial role in Validating the registered office address and ensuring compliance with the necessary requirements.

- A designated partner of the LLP is required to obtain a Digital Signature Certificate (DSC) as all documents and applications related to the LLP will be digitally signed by the authorized signatory. The DSC serves as an essential digital credential, ensuring the authenticity and legality of the documents filed with various authorities during the LLP’s registration and ongoing compliance processes.

LLP Forms

Form name | Purpose of the form |

FiLLiP | Form for incorporation of LLP |

Form 1 | Form for reserving a name for the LLP |

Form 2A | Details of designated partners and other partners of LLP |

Form 3 | Information about LLP agreement |

Form 8 | Statement of Account and Solvency |

Form 11 | Annual Return of Limited Liability Partnership (LLP) |

Frequently Asked Questions:

A- LLP is a combination of both Partnerships and a Limited Company, offering the advantages of both the companies.

A- An LLP is supposed to file 1. LLP Annual return by Filing Form 11. 2. Final Statement of Account and Solvency 3. Income Tax Return.

A- An LLP cannot raise funds from the public in any form. In an LLP only partners can contribute their capital and the liability of the Partners is limited to the extent of their contribution.

A- LLP Registration is the registration of an entity that provides the advantages of a Company and the flexibility of a Partnership firm in a Single organization.

A- It is always better to incorporate an LLP over a Private Limited Company as though both offer the same features. The cost to incorporate an LLP is less as compared to the Private Limited Company. Similarly, the LLP owner holds the ownership as well as control over the Company. The Compliances in the LLP are fewer as compared to a Private Limited Company.

A- The process of starting an LLP is completely online. All you need to do is submit the documents online. Regular follow-ups will be done by our consultants.

A- A minimum of two partners is required to incorporate an LLP.

A- There are various reasons why one should incorporate an LLP. The registration cost is low. No requirement for minimum contribution. No limits on the owners of the business. It is not necessary to carry out an audit. There are fewer tax compliances

A- A Limited Liability Partnership must have a minimum of two Partners and an LLP can have any number of Partners.

A- The designated Partner must be a natural person who is above 18 years of age. LLP Act 2008 allows a foreign national including Foreign Companies to incorporate an LLP in India, provided at least one designated partner is Indian.

A- An LLP can be started with any amount of money there is no such minimum requirement. A partner may contribute both tangible and intangible property.

A- The main purpose of a limited liability partnership (LLP) is to provide limited liability protection for the partners and also allow them to share in the profits and losses of the business.

A- An LLP is responsible for its obligations, which means that the partners are not personally liable for any debts incurred by the LLP. But if an LLP can't pay its debts, the partners only have to pay out any money they've invested into the firm and nothing more.