Non-Banking Financial Company

(NBFC)

Non-Banking Financial Company

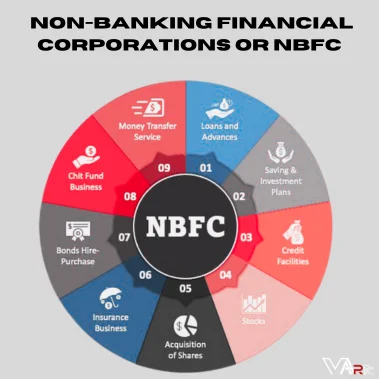

NBFC stands for Non-Banking Financial Corporations. According to Section 451(c) of the RBI Act ,any Company engaged in Financial institution-related activities ,but not a Traditional bank ,is Categorized as a Non-Banking Financial Corporation or NBFC.

A Non-Banking Financial Corporation (NBFC) is a Company Registered under the Companies Act ,1956 or the Companies Act ,2013 ,and is Primarily Engaged in activities such as lending ,Hire-purchase, leasing ,Insurance business, chit funds ,acquisition of stocks and shares ,and sometimes accepting deposits. The functions of NBFCs are Overseen by both the Ministry of Corporate Affairs and the Reserve Bank of India.

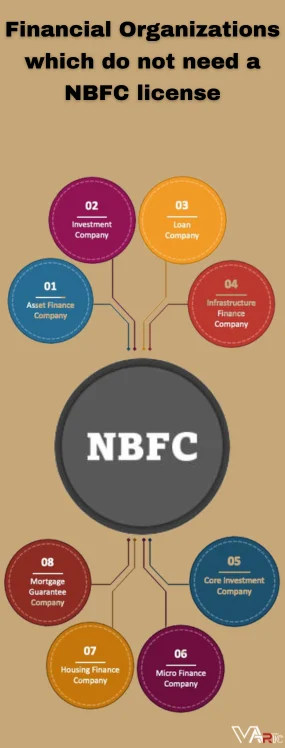

Financial Organizations which do not need a NBFC license

Certain entities engage in financial activities but are exempt from obtaining registration with the Reserve Bank of India (RBI). They fall under the regulation of other financial sector authorities and are not subject to the NBFC registration or regulations of RBI. These exempt entities include:

- Insurance Companies Operating in India are Regulated by the Insurance Regulatory & Development Authority of India.

- Housing Finance Companies which are regulated by the National Housing Bank

- Stock Broking Companies which are regulated by Securities and Exchange Board of India

- Merchant Banking Companies which are regulated by Securities and Exchange Board of India

- Mutual Funds which are regulated by Securities and Exchange Board of India

- Venture Capital Companies which are regulated by Securities and Exchange Board of India

- Companies that run Collective Investment Schemes which are regulated by Securities and Exchange Board of India

- Chit Fund Companies which are regulated by the respective State Governments

- Nidhi Companies Which are Regulated by the Ministry of Corporate Affairs (MCA)

Different Types of NBFCs

The different types of Non-Banking Financial Corporations or NBFCs are as follows:

- On the nature of their activity:

- Asset Finance Company

- Loan Company

- Mortgage Guarantee Company

- Investment Company

- Core Investment Company

- Infrastructure Finance Company

- Micro Finance Company

- Housing Finance Company

- On the basis of deposits:

- Deposit accepting Non-Banking Financial Corporations

- Non-deposit accepting Non-Banking Financial Corporation

Requirements to be fulfilled in order to obtain NBFC license:

The Fundamental requirements Which are to be fulfilled in order to apply for NBFC license are as follows:

- The Company has to be Registered under the Companies Act. That is the Company should either be a Limited Company or a Private Limited Company (PLC).

- The minimum Net Owned Fund of the company must be Rs.2 crore.

What is Net Owned Fund? How to calculate the Net Owned Fund?

The Net Owned Fund (NOF) of a company refers to the funds it owns after Subtracting intangible Assets and reserves from its Total Owned Fund.

The NBFCs can be categorized under two broad heads:

.On the nature of their activity

.On the basis of deposits

Documents that are to be furnished for incorporation of a NBFC

The following documents have to submitted in order to apply and obtain a NBFC license:

- Details about the Company’s Management.

- Certified Copy of Certificate of incorporation

- Certified copy of Certificate of commencement of Business

- Certified copy of updated Memorandum of Association (MoA) of the organization

- Certified copy of updated Articles of Association (AoA) of the organization

- Copy of the PAN card or CIN that has been issued to the organization

- Directors’ profile which has to be duly filled and signed by each director separately

- Certificate of experience from the non-banking financial companies at which each director had worked and obtained experience

- The CIBIL Data applicable to the Directors of the company

- The last 2 years’ financial statements of the relevant unincorporated bodies, if any.

- A Board Resolution to approve the contents of the application and its submission process, and the authorizing signatory

- A Board Resolution to announce that –

- No public deposit has been accepted by the organization previously (mention the time period)

- No Public Deposits are held by the Organization till Date and no Deposits will be accepted thereafter without Prior Permission from the Reserve Bank of India in writing

- A Board resolution specifying that –

- No NBFC activities are being carried on by the organization

- The organization has stopped all kinds of NBFC operations and will not perform the same without receiving registration from the Reserve Bank of India.

- In order to formulate the ‘Fair Practices Code’, a Certified copy of Board resolution is required.

- A Statutory Auditors Certificate certifying –

- that the organization is not holding any Public Deposit

- that the organization does not hold any Public Deposit

- A Statutory Auditors Certificate which certifies that the organization is not involved in any NBFC operation

- A Statutory Auditors Certificate which certifies the net owned fund as on the application date

- Authorized Share Capital details

- Details of the recent patterns of the shareholding of the company along with its percentages.

- Copies of Fixed Deposit receipt & bankers certificate of no loans/debts with account balances supporting Net Owned Funds

- The branch or bank’s full postal address, credit or loan facilities, bank account and balance details, and so on taken by the company.

- For existing companies, the last 3 years’ Profit & Loss account, audited balance sheet, auditors and directors’ reports, etc. are to be submitted.

- The next 3 years’ business plan of the organization with details such as:

- The specific direction of the business

- Market segment

- Income/asset pattern statement sans public deposits, cash flow statement, and projected balance sheets

- Documentary evidence of the company’s startup capital source

- IT Returns or bank statements to be submitted post self-attestation

Frequently Asked Questions:

Non-banking financial companies (NBFCs) are financial institutions that provide a range of specialized financial services, similar to certain banking services ,but without holding a banking license. Unlike traditional banks, NBFCs typically do not offer demand deposit accounts (DDA) to the public. Their functions encompass various financial activities such as providing loans ,home mortgages ,issuing securities ,selling insurance ,and engaging in leasing activities ,among others.

NBFCs come in various forms ,Including housing finance Companies ,Merchant banking companies ,stock exchanges ,firms involved in stock-broking or sub-broking ,currency exchanges ,venture capital fund companies ,and insurance companies ,among others. These Entities Play a Vital role in the financial sector by offering specialized Services and Contributing to the growth and Development of the Economy.

Ans.: As per the rules & regulations of Reserve Bank of India Act, 1934 “No company can commence the business of NBFC unless it has obtained the certificate of NBFC registration and having a net owned fund of Rs. 2 Crore”.

For registering as an NBFC an application to the Regional Office of RBI should be made along with the required documentation.

Reason for the growth of NBFC:

- NBFC has the ability to understand the customer’s profile and offer the best product according to the customer's needs.

- They offer competitive interest rates.

- Provide a flexible repayment scheme and extended loan tenure.

- A minimum number of documents are required at the time of providing financial assistance as compared to banks.

- Loan seekers have flexible eligibility criteria.

A time period has been provided regarding the maximum and minimum time limit for which NBFC can accept the deposit.

Minimum time period: 12 months.

Maximum time period: 60 months.

It is the discretion of deposit accepting NBFC that it can pay back the amount of deposit before its maturity period but such deposit cannot be paid back before 3 months from the date of its acceptance.

If the deposit is paid back after 3 months but before 6 months of its acceptance no interest will be paid.

But if the deposit is paid back after 6 months of its acceptance but before the maturity period then interest shall be paid but that interest shall be lower than 2% of the contracted rate.