Income Tax Registration

Income Tax Registration

Income tax is a type of tax imposed on the income earned by individuals, businesses, and other entities. It is typically levied by the government as a percentage of the income earned, and the tax rates may vary depending on the jurisdiction and the amount of income earned.The tax is usually calculated based on the taxable income, which is the amount of income that is subject to taxation after deductions and exemptions are taken into account.

A tax rebate has been introduced in the New Tax Regime on income for upto Rs 7 Lakhs. This implies that you do not have to pay tax if your taxable income is below 7 lakhs as per the budget 2023.

| Income Slabs | Tax Rates |

| up to Rs 3 lakh | Nil |

| Rs 3 lakh- Rs 6 lakh | 5% |

| Rs 6 lakh-Rs 9 lakh | 10% |

| Rs 9 lakh-Rs 12 lakh | 15% |

| Rs 12 lakh- Rs 15 lakh | 20% |

| Above Rs 15 lakh | 30% |

- The standard deduction of Rs 50,000 has been announced under the new tax regime for salaried taxpayers.

- The Highest surcharge under the New tax regime has been Reduced to 25% from 37% for people earning more than Rs 5 crore. Their tax rate is Reduced as a result from 42.74% to 39%.

- Default tax regime is followed by a new IT regime. The former method is still an option for taxpayers.

- For non-government employees leave encashment has been increased to Rs 25 lakh from Rs 3 lakh.

- TDS rate reduced to 20% from 30% on withdrawal of EPF.

VARTC helps in E-filing of ITR

Easy answer to your queries

We always tries to makes tax filing easy for you.VARTC team also ensures that you do not miss anything.

Give accurate results

VARTC backend team ensures that each return is checked twice for accuracy.

Maximum Tax refund

We always assure that tax filling should be on time & get maximum tax refund.

House Property

Business, Professional & Freelance

Efiling income Tax return

Income Tax refunds

Paying tax due

Salary Income

Capital Gains Income

Other Income Sources

Advance Tax

NRI

HUF

Income Tax Notices

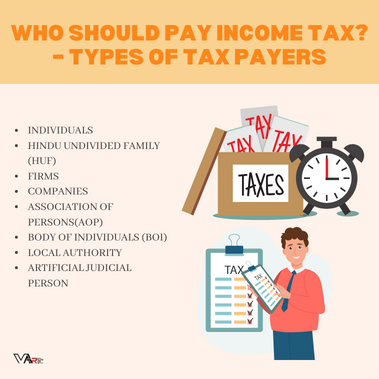

Who should pay Income Tax? – Types of Tax Payers

The Income tax Act classified the types of taxpayers in various categories, rules apply for different types of taxpayers :

- Individuals

- Hindu Undivided Family (HUF)

- Firms

- Companies

- Association of Persons(AOP)

- Body of Individuals (BOI)

- Local Authority

- Artificial Judicial Person

Types of Income Nature of Income

Income from Capital Gains | Taxes are imposed on surplus income from the sale of capital assets such as mutual funds, shares, house properties, etc. |

Income from Business and Profession | Profits earned by self employed individuals, businesses , freelancers or contractors & income earned by professionals like doctors and lawyers, life insurance agents and chartered accountants who have their own practice, tuition teachers are taxable under this head. |

Income from Salary | Income earned from salary and pension is taxable under this head of income |

Income from Other Sources | Income from savings bank account interest, fixed deposits, winning in lotteries is taxable under this head |

Income from House Property | Income earned from renting a house property is taxable under this head of income |

Direct Taxes are broadly classified as :

Income Tax – Income tax is taxation that individuals, Hindu Undivided Families(HUFs)& other non-corporate taxpayers are required to pay on income they receive. The applicable tax rates for this income are determined by the law. Corporate Tax – Income tax is the companies need to pay on the earnings they make from their business. The income tax laws of India specify a specific tax rate for corporations, which is applied to their taxable profits.

Income Tax Forms List

The Seven types of ITR forms are:

- ITR-1: Individuals (residents) having income from salary, one house property, other sources, agricultural income less than Rs 5,000 and with a total income of up to Rs 50 lakh

- ITR-2: Individuals/HUFs not having any business or profession under any proprietorship

- ITR-3: Individuals/HUFs having income from a proprietary business or profession

- ITR-4: Individuals/HUFs having presumptive income from business or profession

- ITR-5: Partnership firms or LLPs

- ITR-6: Companies

- ITR-7: Trusts

Income Tax Saving Procedures

Popular Section 80C Investments | |||||

Particulars | ELSS | PPF | NSC | 5-Year Tax Saving FD | SCSS |

Section 80C Benefit | Yes | Yes | Yes | Yes | Yes |

Type of Investment | Equity | Fixed Income | Fixed Income | Fixed Income | Fixed Income |

Lock-in Period | 3 Years | 15 Years | 5 Years | 5 Years | 5 Years |

Maximum Investment | No Max Limit | Rs 1.5 lakh | No Max Limit | Rs 1.5 lakh | Rs 15 lakh |

The taxpayer can save tax by tax planning. A taxpayer can do tax planning by investing in tax-saving instruments. It helps in reducing the income tax liability. Section 80C to 80U of the Income Tax Act allows a deduction for certain expenditures and investments from the total computed income. Some of the popular Section 80C investments

Popular Section 80C Investments | |||||

Particulars | ELSS | PPF | NSC | 5-Year Tax Saving FD | SCSS |

Section 80C Benefit | Yes | Yes | Yes | Yes | Yes |

Type of Investment | Equity | Fixed Income | Fixed Income | Fixed Income | Fixed Income |

Lock-in Period | 3 Years | 15 Years | 5 Years | 5 Years | 5 Years |

Maximum Investment | No Max Limit | Rs 1.5 lakh | No Max Limit | Rs 1.5 lakh | Rs 15 lakh |