Permanent Account Number (PAN)

Permanent Account Number (PAN) is a unique identification number issued by the Income Tax Department of India. It is a 10-digit alphanumeric number that serves as a proof of identification for various financial transactions and is mandatory for certain activities.

Application for PAN Card: To apply for a new PAN card, follow these steps:

- Fill out the online PAN card application form (Form 49A for Indian citizens, Form 49AA for foreign citizens).

- Provide the necessary details, such as Name, Date of Birth, Address, Contact information, etc.

- PAN card will be generated within 15 days if all the documents are correct and no allegation found

Track PAN Card Application Status: After submitting your PAN card application, you can track its status by following these steps:

- Visit the official website of the Income Tax Department or NSDL e-Governance website.

- Go to the PAN card application status section.

- Enter the required details, such as application number or acknowledgment number.

- Submit the details to check the status of your application.

PAN Card Correction/Modification: If you need to correct or modify the details on your PAN card, you can follow these steps:

- Fill out the online PAN card correction application form (Form 49A for Indian citizens, Form 49AA for foreign citizens).

- Provide the necessary details and select the fields you want to correct.

- Share the required documents as proof of the corrected details to us.

- Submit the application.

Reprint of PAN Card: If you need a reprint of your PAN card due to loss or damage, you can request it by contacting VARTC customer support.

- PAN Card Customer Care: For any queries or assistance regarding PAN card services, you can contact VARTC customer care service through the following channels:

- Phone: You can call the toll-free helpline number provided on the official website.

- Email: You can send an email to the designated email address for PAN card queries.

- Online Chat: Some websites provide online chat support for PAN card-related inquiries.

Remember to keep your PAN card safe and secure and use it responsibly for financial transactions. It is an essential document for various purposes, including filing income tax returns, opening bank accounts, and conducting financial transactions above a specified limit.

PAN Verification

File-Based PAN Card Verification

Screen-Based PAN Card Verification

Software (API)-Based PAN Card Verification

PAN Verification by PAN Number

Verification of Applicability under Section 194N

E-Verify Returns via Aadhaar Card

Details of payment required to register for the Online PAN Card Verification | Organizational details needed to register for Online PAN Number Verification | Digital Signature Certificate details required to register for PAN Verification |

|

|

|

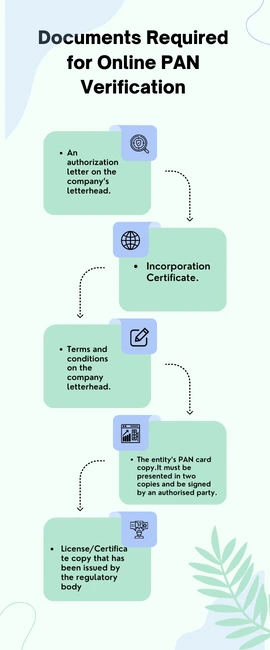

Documents Required for Online PAN Verification

The list of documents that must be submitted are mentioned below:

- An authorization letter on the company’s letterhead.

- Terms and conditions on the company letterhead.

- The entity’s PAN card copy.It must be presented in two copies and be signed by an authorised party.

- Declaration of Entities. It must be presented in two copies and be signed by an authorised party.

- Incorporation Certificate. It must be provided in two copies and be signed by a legitimate organisation.

- License/Certificate copy that has been issued by the regulatory body. It needs to be signed by an authorised party, come in two copies, and be filed.

- Payment for the necessary fees may be made by demand draught or cheque. Make sure to make the cheque or demand draught out to Protean e-Gov Technologies Limited – TIN.

PAN Verification Eligibility

Given below is a list of all the individuals and groups who are eligible for PAN verification.

The PAN verification facility is offered to the below-mentioned entities:

- Payment banks approved by RBI

- Central Vigilance Commission

- Stamp & Registration Department

- Reserve Bank of India

- Income Tax Projects

- Central and State Government Agencies

- Depositories

- Goods and Service Tax (GST) Network

- Commodity Exchanges/Stock Exchanges/ Clearing Corporations

- Entities who are needed to produce Statement of Financial Transaction/Annual Information Return

- Companies that are needed to produced Statement of Financial Transaction/Annual Information Return

- Educational Institutions that have been established by Regulatory Bodies

- Central KYC Registry

- RBI approved credit information agencies

- Depository Participants

- Authorities who issue the DSC

- National Pension System’s Central Recordkeeping Agency

- Credit card institutions

- Mutual Funds

- Insurance Repository

- Insurance Company

- Housing Finance Companies

- RBI approved Prepaid Payment Instrument Issuers

- RBI approved NBFCs

- SEBI approved Investment Advisor

PAN For any queries or assistance regarding PAN card services

Remember to keep your PAN card safe and secure and use it responsibly for financial transactions. It is an essential document for various purposes, including filing income tax returns, opening bank accounts, and conducting financial transactions above a specified limit.