Importer -Exporter Code

Registration

In today’s global business landscape ,many companies are venturing into the international market to expand their offerings and reach. This expansion often involves activities like importing and exporting goods and services. However ,when conducting business transactions overseas ,it is essential for businesses to comply with the regulations and requirements set by their respective governments. In India ,one such requirement is obtaining an Importer-Exporter Code (IEC) before engaging in any online transactions.

As per the Government of India ,the Importer-Exporter Code (IEC) is an essential identification number required for businesses involved in exporting from or importing to India. It is governed by the Foreign Trade (Development and Regulation) Act of 1992. The Directorate General of Foreign Trade (DGFT) is responsible for issuing this unique 10-digit number. The IEC Registration Certificate holds significant importance for businesses engaged in import and export activities.

Individuals ,as well as corporate entities ,have the opportunity to register for Import or export activities in India. The Importer-Exporter Codes (IEC) do not need to be renewed as they are assigned with lifelong validity ,meaning they remain valid until the business discontinues its operations. The application process for IEC Registration is conducted online through the Directorate General of Foreign Trade (DGFT) website ,and the necessary documents are submitted along with the application.

It’s Important to note that an Importer-Exporter Code (IEC) is not mandatory for service exports unless the service provider is eligible for incentives under the Foreign Trade Policy. In such cases ,when service providers are entitled to receive incentives, they are required to obtain an IEC.

- In today’s globalized world ,the increasing interconnectedness of markets presents numerous cross-border commercial opportunities. To tap into these opportunities effectively, individuals can leverage the Import Export Code (IEC) registration. This registration process enables individuals to capitalize on the benefits of globalization and expand their business ventures across international borders. By obtaining an IEC, individuals can unlock the potential for growth and take full advantage of the diverse range of cross-border commercial options available to them.

Importance of IEC

- In order to engage in the import and export industry ,Importers and Exporters are required to undergo the process of IEC registration. This registration is essential for Facilitating the import and export of products and Services. It is important to note that without obtaining an IEC ,no individual or entity can participate in the Import/Export industry. Unless exempted under specific circumstances ,it is Mandatory for all individuals to obtain an IEC in order to conduct export or import activities.

- The provision of an IEC code serves the purpose of monitoring and documenting the international business operations of a company. This unique 10-digit number allows for efficient tracking of all activities related to cross-border trade. In the era of globalization, numerous opportunities for international commerce arise, and obtaining an Import Export Code registration enables individuals to seize these prospects and expand their business globally.

Benefits of IEC

- Expanding into the Global Market: The registration of an Import Export Code (IEC) is vital for businesses engaged in import and export activities. It enables individuals to enter the international market, thereby enhancing and advancing their business standards. By obtaining an IEC registration, businesses can seize opportunities in the global market and propel their growth and success.

- An entry point for international transactions: It is the first document required to begin doing business internationally.

- Improves the quality of business: By extending its global reach, IEC registration helps to maintain commercial ties and enhance company quality.

- Imposes control over illegal Trading: You must supply true and correct information in order to be granted an IEC Registration. Without obtaining complete and precise information, the department cannot issue an IEC registration, therefore preventing the unlawful trafficking of goods.

- Additional benefits: IEC is valid for life. Additionally, companies are not needed to update their registration. Additionally, there are incentives offered by organisations like the Export Promotion Council and DGFT Customs. Businesses can also get their taxes back that they paid while exporting products.

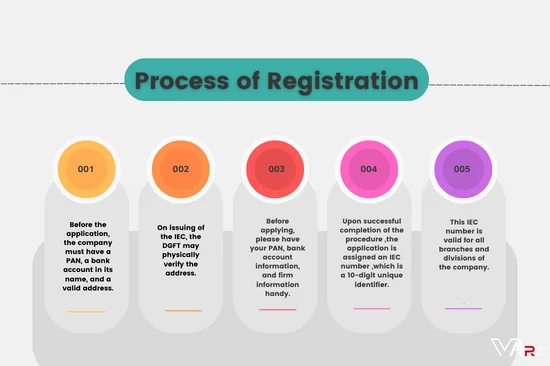

Process of Registration

A company can apply for the IEC code: In India ,the following types of Entities can apply for an IEC code proprietorships ,Partnerships ,limited liability partnerships (LLPs) ,limited Companies ,Trusts ,Hindu Undivided Families (HUFs) ,and societies.

Before the application, the company must have a PAN, a bank account in its name, and a valid address.

On issuing of the IEC, the DGFT may physically verify the address.

Before applying, please have your PAN, bank account information, and firm information handy at the time of registration.

- In the case of offline registration: To apply for an Importer-Exporter Code (IEC), the applicant should submit their application to the Regional Authority of the Directorate General of Foreign Trade (DGFT) that is closest to them. The applicant needs to fill out the necessary forms, specifically Form – ANF2A (Aayaat Niryaat), and submit it along with the required documents.

- For a single applicant’s PAN number, a single IEC will be given.

- In the case of online registration: The ANF2A form required for the application can be obtained from the website in either PDF or Word format. Additionally, Appendix 18B needs to be attested by the bank authorities on their official letterhead. The applicant should also include two passport-sized photographs

Upon successful completion of the procedure ,the application is assigned an IEC number ,which is a 10-digit unique identifier. This IEC number is valid for all branches and divisions of the company.

Understand the Requirement of Import Export Code Registration

When establishing an import and export company in India, it is mandatory for firms and businesses operating within Indian territory to obtain the Importer-Exporter Code (IEC) in accordance with government regulations. The IEC is a crucial requirement for conducting any export or import transactions. Anyone Wishing to begin an Import-Export firm in the nation must get an Import & Export (IEC) licence.

The Import-Export Code (IEC) is primarily Utilized by importers and exporters as a prerequisite. Its absence hinders them from accessing the Export Schemes and various benefits Provided by the Directorate General of Foreign Trade (DGFT).

Additionally, the following situations make the demand for Import Export Code Registration even more crucial:

- When an importer is needed to clear his goods from customs, the customs officers demand it.

- When an importer sends money overseas via banks, the banks are required to know the IEC Code.

- The customs port will demand it if an exporter needs to transfer his products.

- In the case where an exporter gets money in a foreign currency directly into his account ,then the bank requires it.

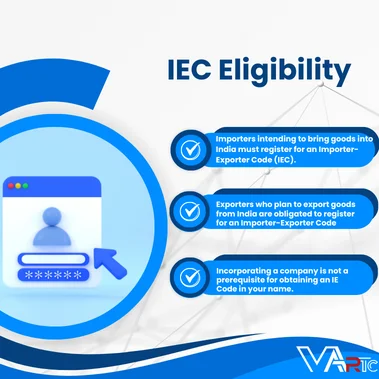

IEC Eligibility

- Importers- Importers intending to bring goods into India must register for an Importer-Exporter Code (IEC). When clearing customs, importers must provide the IE Code as a reference. Furthermore, banks require the IE code of the business or individual when conducting international money transfers.

- Exporters- Exporters who plan to export goods from India are obligated to register for an Importer-Exporter Code (IEC). The IE Code must be mentioned while dispatching shipments. Moreover, banks require the IE code of the business or individual when receiving funds from overseas.

- Proprietors- Incorporating a company is not a prerequisite for obtaining an IE Code in your name. Even individual business proprietors have the option to acquire an IE code.

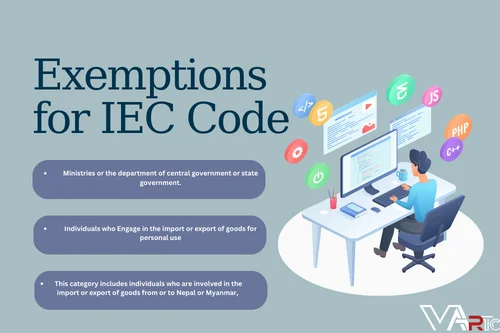

Exemptions for IEC Code

- Individuals who Engage in the import or export of goods for personal use ,excluding business manufacturing or agriculture ,fall into this category.

- This category includes individuals who are involved in the import or export of goods from or to Nepal or Myanmar, with a condition that the value of the goods does not exceed Rs 25,000 in a single transaction, and the transaction takes place exclusively through the border areas between Indo and Myanmar.

- Ministries or the department of central government or state government.

IEC (Import Export Code) Registration Documentation Requirement

- A copy of a person’s or company’s PAN Card.

- Voter identification, an Aadhar card, or a copy of a passport.

- Cancellation copies of existing cheques of current bank accounts for individuals or businesses.

- Copies of the lease agreement or the electric bill

- Bank Certificate as per ANF 2A/

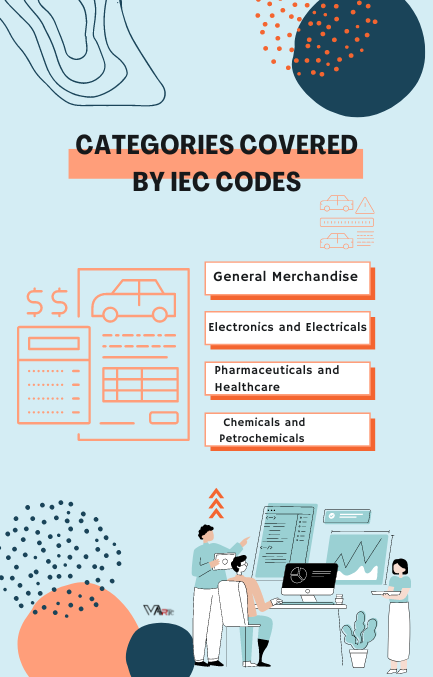

Categories Covered by IEC Codes

The IEC codes cover a wide range of categories, including but not limited to:

General Merchandise

- Businesses that Import and Export common items and commodities fall under this Category.

Electronics and Electricals

- Businesses involved in the Import and Export of electronic gadgets ,electrical equipment ,components ,and associated goods fall under this category.

Pharmaceuticals and Healthcare

- This category includes companies that deal with the import and export of Medicines ,Medical devices ,healthcare items ,and medications.

Chemicals and Petrochemicals

- Businesses Involved in the import and export of Chemicals ,petrochemicals ,Fertilizers ,and related Products fall under this Category.

Frequently Asked Questions:

A: The Import-Export Code (IEC) is not necessary for personal use imports or exports. It is exclusively required for commercial and corporate activities.

A:

When engaging in export or import activities ,as well as receiving or making payments ,having an IEC code is mandatory. It is important to note that there are no post-registration compliances for the Import-Export code in India ,which means there is no requirement to file returns.

A: The registration for IEC is a one-time process ,and once obtained ,it remains valid for a lifetime. Hence ,there is no need for the IEC code to be renewed.

- A: Government departments are in charge of import and export.

- Personal-use products are imported or exported.

- Certain notified charitable NGOs handle the import and export.

A: No separate IEC codes are needed for import and export activities. A single IEC Code registration is sufficient to engage in both import and export operations within a business. Accountant (CA) as the auditor of the Company. The auditor needs to verify the books of accounts then on the basis he issues a Statutory Audit report.

The VARTC Team is here to assist you with IEC code registration. Our dedicated team is available to provide support and answer any inquiries you may have. For further information, please feel free to contact the VARTC Team.