Shop and Establishment License

Shop and Establishment Registration

Every state has its own Shop and Establishment Act ,although they generally follow similar provisions. The State Labour Departments are responsible for regulating the Shop Act and issuing licenses accordingly. Consequently ,there may be slight variations in the requirements from state to state. The Shop and Establishment Registration Act governs all shops and commercial establishments within each respective state.

As per the provisions of the Shop and Establishment Act ,a shop refers to a place where goods are sold or provided ,whether it is retail or wholesale ,or where services are rendered. Commercial establishments typically employ individuals for office-related work, such as commercial, financial ,trading, or insurance companies. The following are some examples of commercial buildings: offices, godowns ,storerooms, and warehouses. Additionally, the term encompasses hotels, boarding houses, restaurants ,cafes, theaters ,and other public entertainment venues. However ,it is important to note that factories and industries are not covered under the Shop and Establishment Act. They are governed by the Factories Act of 1948 and the Industries (Development and Regulation) Act of 1951.

Why Was the Shop Act License Introduced?

- To Impose Rules Based On Local Culture and empower states: The legislation explicitly grants states the authority to formulate regulations and rules concerning the labor workforce employed in commercial establishments. This provision enables states to address specific requirements and make appropriate exceptions as needed.

- To Convert Unorganized Sector Into Organised: The Government endeavors to transform the Unorganized sector into an Organized industry by implementing comprehensive rules and Regulations.

- Mandates registration: Entrepreneurs are required to register their businesses under the Shop and Establishment Act ,which serves as a crucial step in organizing and overseeing this sector. As more small shops and commercial establishments Register ,the Government will be better Positioned to offer improved assistance and resources to Support their growth and development.

- To Regulate Wages Of The Employees: Previously, shops and commercial establishments had the freedom to determine employee salaries and wages without regulation. This often resulted in significantly lower payments for daily wage workers and laborers, with business owners escaping accountability. However, with the implementation of the Shops and Establishment Certificate, holders are now obligated to adhere to government regulations regarding wages and ensure that each employee is treated fairly and provided with the appropriate care they deserve.

- Stop Child Labour: One of the significant provisions of the Shop and Establishment Act is the prohibition and punishment of child labor. Prior to the implementation of the shop act license ,child labor was prevalent, causing immense harm to the lives of children. However, through government regulations and rules related to the shop and establishment license, the practice of child labor has been deemed illegal and is subject to strict consequences.

- Healthy Working Conditions: Irrespective of the business’s condition ,shop act registration mandates that business owners maintain a conducive working environment and Provide facilities such as washrooms and baby care rooms to ensure the well-being of their employees.

Benefits of Shop and Establishment License

Legal Right to Conduct Business

Acquiring a shop and establishment license and presenting proof of business structure ,such as a partnership firm or sole proprietorship ,grants business owners the legal authorization to operate within the jurisdiction of the Act. This ensures protection against harassment and Unnecessary interference from law enforcement officials.

Ease of Opening Business Bank Account

In accordance with RBI regulations ,it is mandatory for every business to maintain a separate business account for managing its finances. The Shops and Establishments Act stipulates that only a Certificate can be utilized to open this designated business account.

Hassle-free Inspections

The Shop and Establishment License grants businesses access to various government schemes aimed at supporting small enterprises. By registering under the shop act, businesses can avail themselves of benefits such as low-interest bank loans, financial plans, and other programs designed to foster their growth and development.

Availing Government Benefits

The Shop Act License offers businesses the opportunity to access government schemes specifically designed to promote small businesses. By registering under the shop and establishment legislation, businesses gain eligibility for benefits such as low-interest bank loans, financial plans, and various programs aimed at supporting their growth and development.

Encourage Expansion

By obtaining a legal entity status and fully complying with the shop act registration requirements ,a dedicated business owner can enhance the market position of their entity. This ,in turn ,enables the business owner to expand their reach to new consumers and strengthen their presence in the market.

Documents Required for Shop and Establishment Registration

We offer seamless and fully digital end-to-end services for fulfilling your online shop act registration requirements. Experience a hassle-free process with our efficient services. Please prepare your documents as soon as possible

- Shop or business address proof

- ID proof

- PAN card

- Payment challan

- Additional business licenses necessary to start a business

Process For Obtaining Shop and Establishment Registration

- The process of obtaining the Shop and Establishment Registration Certificate varies across different states. It can be acquired through either online or offline channels, depending on the specific requirements of each state.

- To obtain the registration certificate online, the shop or business proprietor/owner needs to access the website of the respective State Labour Department. They should complete the application form for registration under the Shop and Establishment Act, upload the required documents, and make the prescribed fee payment, which may vary across states. Upon approval of the registration form, the proprietor or owner will receive the registration certificate online.

- To obtain the registration certificate offline, the proprietor or owner needs to fill out the registration application and submit it ,along with the prescribed fees, to the Chief Inspector of the relevant area. The Chief Inspector will carefully review the application for accuracy and, once satisfied ,issue the registration certificate to the proprietor or owner.

- The registration application form includes essential information such as the employer and establishment’s name ,address ,establishment category ,number of employees ,and other relevant details as required. It is Necessary to renew the Registration application before the expiration of the registration period. The validity of the Shop and Establishment Certificate may vary from state to state. Some states offer lifetime validity ,while others provide certificates valid for a duration of one to five years.

Closure of Shop or Establishment

In the event of a Shop or Establishment closure ,the occupier is required to notify the Chief Inspector in writing within 15 days of the closure. Subsequently ,the Chief Inspector will cancel the registration of the Shop or Establishment and remove the business from the official register.

Regulations Under The Shop Registration Act

As part of the Act, the following matters are regulated:

- Work hours, annual leave, weekly holidays

- Compensation and wages

- Employing children is prohibited

- Women and young people cannot work night shifts

- Inspected and enforced

- Rest interval

- Hours of operation

- Employers’ record keeping

- Terms of dismissal

Steps Involved In Shop Act Registration

Step 1:

Contact our Experts

Schedule an appointment with our team of experts at VARTC. They will assist you in addressing any concerns or questions you may have regarding the shop and establishment registration Process ,and initiate the necessary procedures on your behalf.

Step 2:

Submit your Documents

Please submit all the required documents for shop and establishment registration to our associates at VARTC, as per their specific requirements. Kindly ensure that you provide the necessary documents accordingly.

Step 3:

Inspection & Approval

During the inspection process, the labor department will verify the information provided in your application and review the accompanying documents. Typically, inspections are not always required, as authorities often approve applications based on the submitted documentation and a visit to the business location. Once approved, we will conveniently deliver your shop act license directly to your doorstep.

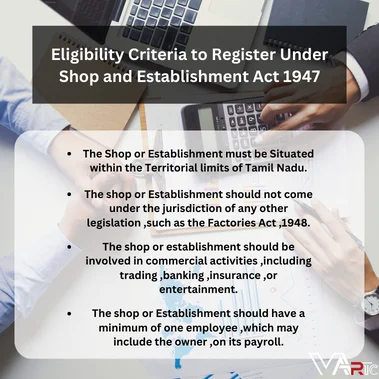

Eligibility Criteria to Register Under Shop and Establishment Act 1947

- The Shop or Establishment must be Situated within the Territorial limits of Tamil Nadu.

- The shop or Establishment should not come under the jurisdiction of any other legislation ,such as the Factories Act ,1948.

- The shop or establishment should be involved in commercial activities ,including trading ,banking ,insurance ,or entertainment.

- The shop or Establishment should have a minimum of one employee ,which may include the owner ,on its payroll.

Documents to Be Annexed to the Prospectus

Penalties under the Shop and Establishment Act differ from state to state and can encompass monetary fines, operational repercussions, or even imprisonment. Non-compliance with the act poses a significant risk, as it may result in closure notices and substantial financial penalties.

Frequently Asked Questions:

Ans- The establishments owned by the central and state government are exempted from the requirements outlined in the Shop and Establishment Act. Consequently, there is no obligation for the establishments of the central and state government to obtain Shop and Establishment Act Registration.

A- The following entities are required to obtain the Shop and Establishment Act Registration:

- Retail and wholesale shops

- Premises where services are rendered to customers including office

- Workhouse or workplace used for trade or business

- Theater or place of public entertainment or amusement

- Commercial establishment

- Storeroom, warehouse or godown

- Restaurant or eating house

A- The Shop and Establishment Act is applicable nationwide. However, each state/union territory has its own act to regulate entities operating within its jurisdiction. While there may be variations in the specific provisions across states, the general provisions of the act remain similar throughout the country.

A- Factory owners are not obligated to register under the Shop and Establishment Act as they are governed by a distinct legislation known as the Factories Act ,1948.

A- The registration form for the Shop and Establishment Act Certificate contains the following details:

- Name and address of the establishment

- Full name of the employer

- Category of establishment

- Nature of business

- Name of the manager

- Date of establishment commencement

- Employee details

If you are facing challenges in initiating your shop due to the Shop and Establishment Registration process, there’s no need to worry. The dedicated team at VARTC is here to assist you, providing guidance and support on obtaining the necessary license for your shop and establishment.