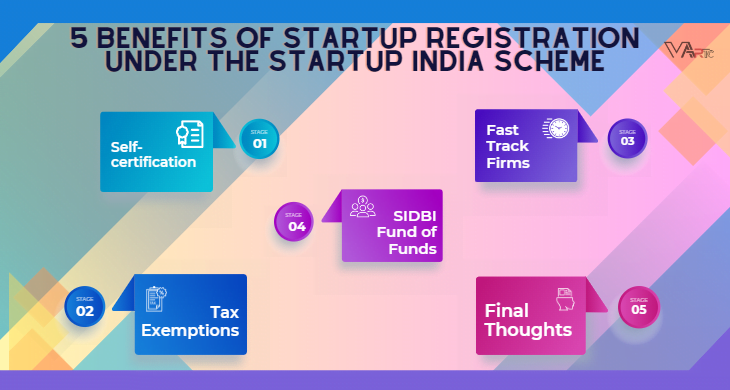

The startup must be acknowledged by the Department of Industrial Policy and Promotion in order to receive any advantages under the Startup India Plan (DIPP). Some of the advantages of the plan include the following:

Self-certification

Six labour regulations and three environmental statutes are subject to self-certification by organisations registered under the Startup India scheme. This lessens the regulatory burden on startups. Instead, the businesses may focus on their primary operations while minimising their compliance expenses.

For five years following the date of formation, startups are permitted to self-certify their compliance. For a period of three years, units operating in one of the 36 white category industries are exempt from environmental clearance under the applicable environmental regulations.

Tax Exemptions

Most businesses are concerned about taxes, and the Indian government is working to make sure that in the early years, capital requirements are not that stressful. For three years, recognised startups that receive an Inter-Ministerial Board Certificate (IMB Certification) are exempt from paying income taxes. Moreover, investments beyond Fair Market Value and capital are exempt for certified startups.

Fast Track Firms

With startups, things don’t always go as planned. “Fast track firms” are startups that have received recognition under the Startup India scheme. As opposed to other companies, who must complete their operations within 180 days, fast track firms can do so in 90 days. Within six months of the application filing, the startup’s insolvency professionals will assist in the asset liquidation process and pay creditors.

Faster Patent Application and IPR protection

Startups participating in the Startup India scheme will also receive an 80% fee reduction in addition to a streamlined patent application procedure. Also, compared to other businesses, there is a 50% rebate offered for trademark filing. Additionally, the government has a group of facilitators who will offer basic advice to startups on IPR protection and promotion, and the government will cover the entire cost of their services.

SIDBI Fund of Funds

10,000 crores have been set aside by the Indian government and are being administered by SIDBI as a fund to support startups in the country. The government contributes to the capital of SEBI-registered venture funds in this “Fund of Funds,” which then invests in startups.

The most recent data available indicates that 97 businesses have already received investments totalling 400 crores through this programme.

Final Thoughts

However, joining Startup India is just the outset of your startup’s journey. Startups need more than administrative procedure facilitation and flexibility to be able to expand sustainably.

You must put together a fantastic team early on if you want to ensure success as an early-stage startup. Also, even if the goal is to raise money, you should consider acquiring smart money when you pitch to investors.